- You have limited knowledge about investment and the procedure involved.

- You do not have the time to monitor and rebalance your investment.

- You are unaware of market volatility and ways to safeguard your investments in times of market uncertainty.

- You have a high net worth with a minimum investment of Rs50 lakh.

- You are looking to diversify your investment to reap benefits across multiple asset classes such as stocks, debts, equities, and so on.

Optimizing and channelising your investments for a secure financial future

12%++*p.a

returns on average

5+

fund manager expertise

15+ years

Experience in wealth management

What is PMS ?

Portfolio Management Services offer you professional investment management aimed to work around your customised investment strategy to cater to your growth and wealth needs. Whether you're planning for your retirement or looking to grow and secure your wealth, having the right PMS helps in all avenues.

Types of PMS

PMS can be classified based on two key factors

Investment Control

Who holds the authority over decision-making and execution in your portfolio and how his investment decisions are.

Asset Class of Investments

The categories of investment instruments used, such as equities, debt securities, or a combination.

Investment Control based

Active Portfolio Management

The portfolio manager's primary goal is to maximise returns i.e generate alpha returns. In the Active Portfolio Management method, the portfolio manager attempts to reduce the risk of your investments by diversifying them across asset classes, industries, and businesses. When compared to the passive style, this results in a higher portfolio value generated.

Passive Portfolio Management

This method focuses on fixed profiles that are in line with the current market trend. In this case, portfolio managers prefer to invest in index funds which grow passively over time with minimal intervention. They have a low portfolio growth value but offer reasonably good long-term returns.

Discretionary Portfolio Management

The portfolio manager is entrusted with managing a specific portfolio in this method. Based on your objectives, risk tolerance, and investment duration, the manager selects an appropriate strategy that they believe is best suited to your portfolio. For example, portfolio managers may recommend equity-oriented funds to a risk-taking investor and debt-oriented funds to a risk-averse investor.

Non-Discretionary Portfolio Management

In this method, the portfolio managers advise you on investing, but the final decision is yours. Once you give the go-ahead, the portfolio managers take the appropriate action on your behalf.

Asset Based

Equity

Equity PMS focuses primarily on investing in diverse equity instruments like listed public shares, private equity and equity-oriented mutual funds. Such PMS are suitable for high risk profile investors seeking long-term capital appreciation.

Debt

Debt PMS involves creating a portfolio mix of debt instruments, such as bonds, debentures, commercial papers and T-bills, tailored to meet the investor's specific financial goals. Such PMS are suitable for low risk tolerance investors with stable investment gain expectations.

Hybrid

Hybrid PMS combine investments in both equity and debt instruments to create a balanced portfolio with a balanced risk profile depending on the equity-to-debt ratio. Such PMS are suitable for investors looking for a balance between growth and income and those seeking diversification within a single portfolio.

Multi-Asset

Multi-Asset PMS diversify beyond traditional equity and debt instruments by including assets like gold, Real Estate Investment Trusts (REITs), Infrastructure Investment Trusts (InvITs), and other alternatives. Suitable for investors with a varying risk profile and Investors seeking broader diversification with interests in alternative assets

Which PMS is right for you ?

PMS is best suited for investors who want customised investment strategies and are comfortable with higher risk-return trade-offs. Choosing the right PMS provider requires considering the following

Why

PMS with Taurus?

Who can invest in PMS ?

Objectives of Portfolio Management Service

- Capital Appreciation: Generating returns that outperform the market and inflation, leading to the growth of invested capital.

- Risk Management: Balancing risk and reward to align with the investor's risk tolerance.

- Diversification: Spreading investments across various asset classes to mitigate the impact of market fluctuations.

- Liquidity Management: Ensuring that the portfolio maintains an optimal balance between liquid and illiquid assets.

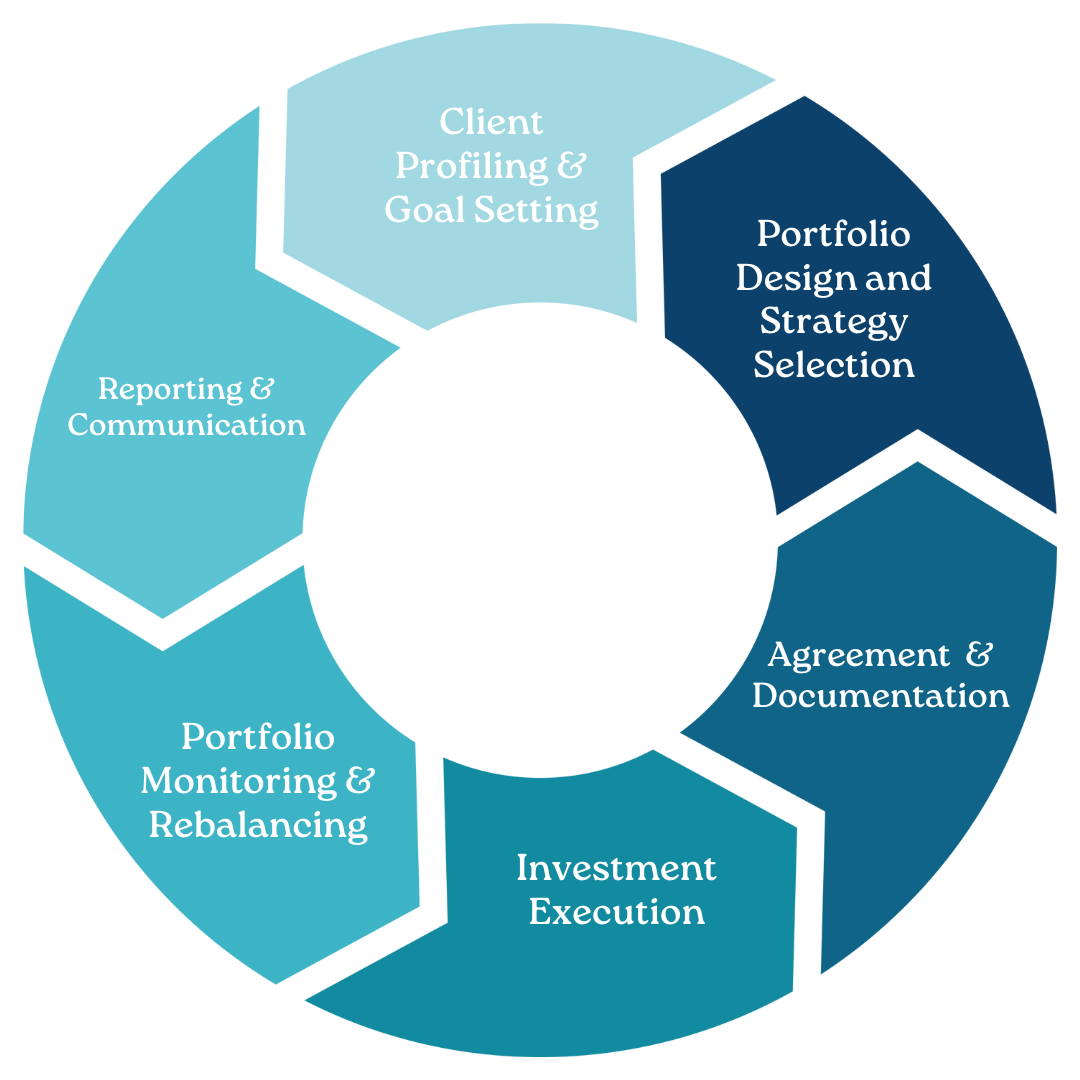

Steps to open an account

Register

Complete the online registration form by providing your personal details to create a secure account.

OPEN ACCOUNTVerification

Submit the required documentation and complete the certification process to confirm your identity and compliance.

Start investing

Fund your account and start trading with access to investments and tools.

UPI Handle PMS

Request A Call Back

Simplify your investment journey with our platforms

Simplify your investment journey with our platforms, crafted to offer a smooth process and rewarding results.

Enjoy real-time market updates, latest features and a seamless trading experience.

Comprehensive portfolio view and analysis for effective investment management.

Advanced charting tools for in-depth market analysis.

User-friendly interface for quick and easy trading.

Testimonials

What our happy client say.

As a process transformation company, we rethinks and rebuilds processes for the digital

FAQs

In discretionary PMS, the portfolio manager has the authority to make investment decisions on behalf of the client. In non-discretionary PMS, the manager provides recommendations, but the client makes the final decision on transactions.

Consider factors such as the provider's track record, investment strategies, fees, client reviews, and the level of customization offered. It’s also important to ensure the provider is regulated by relevant financial authorities.

PMS fees generally include a management fee (a percentage of assets under management) and sometimes a performance fee (based on the portfolio's returns). Fee structures can vary among providers.

While PMS is often geared toward high-net-worth individuals, some providers offer scaled-down options for smaller investors. It’s important to evaluate if the service aligns with your investment goals and budget.

Most PMS providers offer regular updates, typically on a quarterly basis, including detailed performance reports and market analysis. Some may also provide real-time access through online platforms.

Withdrawal procedures and timelines vary by provider. Generally, you’ll need to submit a withdrawal request, and the portfolio manager will process it according to the terms outlined in your agreement